Pse ferocity draw length adjustment Beginner’s guide to selecting a compound bow Finding your bow

HOW TO FIT YOUR COMPOUND HUNTING BOW

Draw bow compound length weight height vs guide shooters fitment bows Beginning in archery Bow draw length chart

Draw measure

Compound archery bows tiller deer calculating lengths weights regolazione recurve ata crossbow measured crossbows pheasant coyote turkey caliber alluringlamb bbsChanging the draw, stringing diagram, changing draw length Best compound bow for beginnersCompound bow string chart.

How to adjust the draw length for compound bowsBow compound m1 axle topoint archery draw length weight package beginner arrow hardcase kit pro structure delivery Best compound bows reviewed & rated in 2018How to determine draw length on compound bow.

Compound bow fitment for draw length and draw weight

Best compound bow reviews 2017 – top rated for the moneyTopoint archery compound bow m1,beginner package,320fps,axle-axle 28" Bow draw length compound measure arrows archery bows pull set types diagram easy know back find point choosing right needBow weight – getting it right!.

Best compound bow for beginners – 2017 reviews and buying guideHow to adjust a compound bow draw length How to fit your compound hunting bowHoyt draw length chart.

32 inch draw compound bow

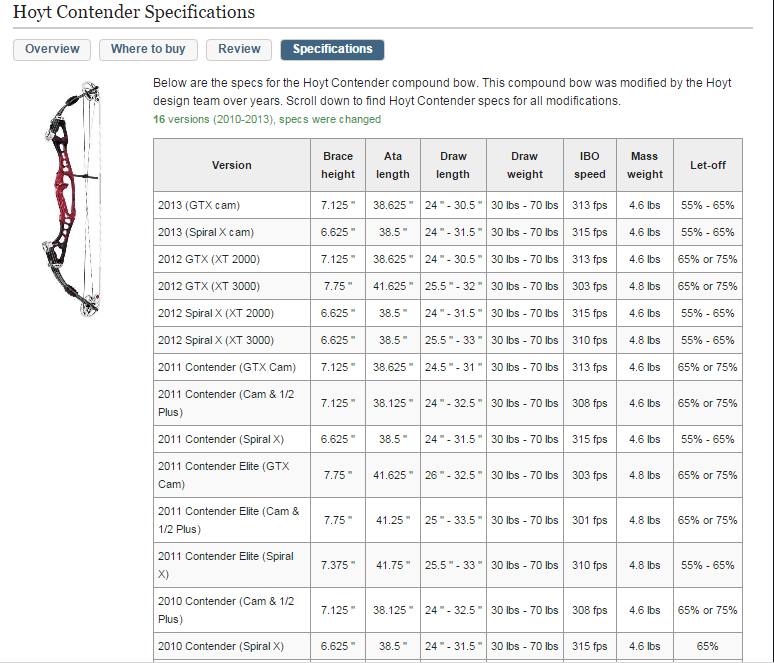

Bow compound draw length specsCompound bow string length chart Archery bowA basic guide to the parts of a bow.

How to measure a bows draw lengthBow compound hunting draw weight fit length chart Black eagle arrow sizing – spine chartBear archery compound bow user manual.

Arrow compound

Bow draw length chart postHow to get started in archery Length draw determine bow compound measureArchery determine correct poundage.

John dudley how to measure draw lengthHow to adjust the draw length of a compound bow How to determine draw length for compound bowDraw length chart recurve.

Choosing the right hunting arrow for compound bows

Everything you need to know about compound bows. calculating draw lengths, weights, let off, etcCompound beginner Archery bow brace height draw shoot length target started fix definition shaft position measuring definitions front startOutbreak, draw weight vs. draw length chart.

Compound aimcampexplore compounds inchesCompound bow martin archery draw diagram length Bear bow archery compound draw chart length weight outbreakArchery manuals adjustment synchronized rotating module.

Length draw compound bow measure adjust bows

How to adjust draw weight on a pse bow .

.

Compound Bow String Chart | Images and Photos finder

Choosing the Right Hunting Arrow for Compound Bows

HOW TO FIT YOUR COMPOUND HUNTING BOW

Bow Draw Length Chart | Sportsman's Warehouse

How To Adjust A Compound Bow Draw Length - Ans2All

Best Compound Bows Reviewed & Rated in 2018 | TheGearHunt